M1 Index-Based Equity Strategies

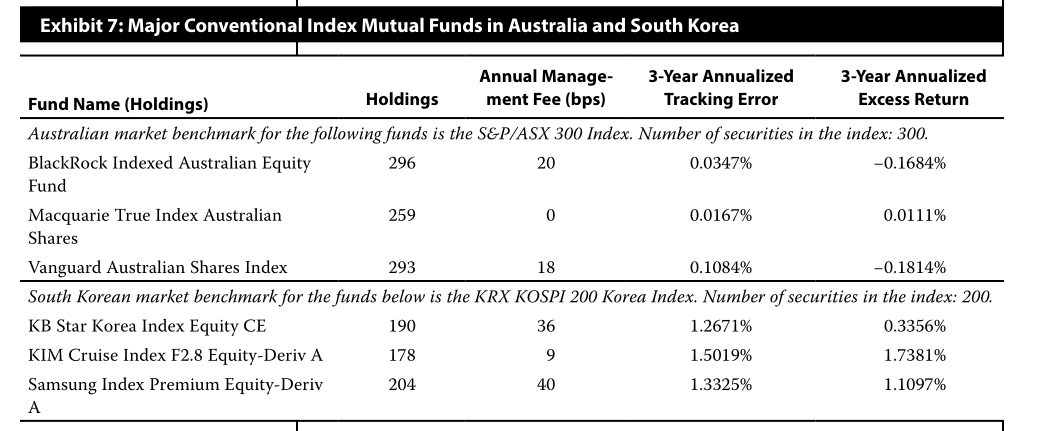

Exhibit 7 illustrates key portfolio metrics for three of the older and larger conventional open-end funds in the Australian and South Korean markets. Based on the levels of tracking error and excess return figures provided in the exhibit, explain whether the funds are likely replicating or sampling.

解析:

Solution: Based on the number of stocks in the fund compared to the index constituent number, it appears most funds are attempting to replicate. Two of the funds (Macquarie True Index and KIM Cruise Index) have 80% to 90% of the stocks in the index, which indicates they are more likely to be using sampling. One fund (Samsung Index Premium) actually holds more than the index, which can happen if buffering is used. No fund contains the same number of stocks as constituents in the index. Thus, it is not surprising that the funds failed to track their respective indexes perfectly. On an annualized basis, tracking error for the Australian funds is less than one-tenth the level of the Korean funds. However, the Korean funds’ excess return—which is fund return less the benchmark index return—is positive in all three cases. The negative excess returns for two of the Australian funds are relatively close and possibly attributable to their management fees of 18–20 basis points.

閱讀排行

-

1

重磅利好!CFA入選國家緊缺清單,含金量暴漲的背后意味著什么?

-

2

CFA和FRM到底應該報考哪個?

-

3

重磅發(fā)布丨CFA被納入《北京市國際職業(yè)資格認可目錄(2025年版)》急需緊缺國際職業(yè)資格清單

-

4

??CFA備考教材怎么選?官方教材vs notes對比,看完這篇就懂了!?

-

5

CFA證書含金量怎么樣,CFA證書價值有哪些?

-

6

??CFA考前3個月心態(tài)崩了?如何科學調整并穩(wěn)住復習節(jié)奏?

-

7

CFA證書對從事金融行業(yè)有哪些助力?

-

8

CFA證書在不同城市可以享受到的福利政策有哪些?

-

9

CFA證書和FRM證書選擇哪個?

-

10

拿下CFA證書有哪些工作機會?